Entities

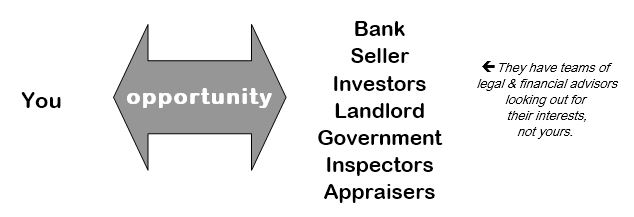

Small businesses face many of the same legal issues as big businesses, yet they usually do not have a fully staffed legal department to turn to when these issues arise. Worse, many of the issues that carry the most significant consequences, both professionally and personally, must be faced upon formation and shortly thereafter.

If you are thinking about starting a business, or changing your current business designation, you will face numerous legal decisions, and the ramifications may not be readily apparent. Business formation involves issues such as the type of business entity, permits, licenses, tax considerations, personal and financial liability, and contractual obligations, just to name a few. Do not make these decisions without professional advice.

We offer a wide range of services to help you get your business get off the ground and started in the right direction. Whether you need formation assistance, manuals and handbooks, employee forms, or contract or lease reviews, we can help.

Choosing a Business Entity

Once you’ve decided to start your own business it is important to choose the right type of entity. There are various factors to consider when making this important decision, such as:

- How will your business be managed?

- How will it be funded?

- Will you hire employees or independent contractors?

- Will your business carry an inventory?

- How can you limit your personal liability?

The following chart gives a brief comparison of the various entities and how they differ regarding formation, liability, risk, and some tax considerations.

| Creation | Liability | Risk | Tax Concerns | |

|---|---|---|---|---|

| Sole Proprietorship | By operation of law (no need to file documents or sign agreement | personal liability | Personally liable for 100% of the risk | business income is taxed as personal income |

| General Partnership | By operation of law when 2 or more people are in business together for profit (no need to file documents or sign agreement) | Usually, each partner is personally liable for all partnership obligations | Risk is shared among the partners, but each is personally liable | Each partner’s share of the profit is taxed as personal income |

| Limited Liability Partnership (LLP) | Certificate of Limited Partnership files with SDAT | Partners generally have no personal liability for LLP obligations | All partners share the risk equally | Each partner’s share of the profit is taxed as personal income |

| Limited Liability Company (LLC) | File Articles of Organization with SDAT | Members generally have no personal liability for LLC obligations | Risk is distributed both horizontally & vertically | All profits & losses are passed through to the Members and taxed as personal income |

| Corporation | File Articles of Incorporation with SDAT | Shareholders generally have no personal liability for corporate obligations | Risk is distributed both horizontally & vertically | C Corps taxed at both the corporate and personal level; losses can be retained for future years and offset against income. S Corps: profits & losses are passed through to shareholders and taxed as personal income. Not all losses can be carried forward. |

Roper DiBlasio can be your business’ legal resource, to handle matters from collections, contract review, and employment to environmental or litigation. We offer many flexible retainer and payment options to fit your business’ needs. Call today to discuss establishing a Business Retainer Account.